Business and Industry: Key Players, Trends, and Manufacturing Insights in India and Beyond

When you think about Business and Industry, the systems and organizations that produce goods and services to meet market demand. Also known as industrial economy, it’s what keeps factories running, supply chains moving, and jobs alive—especially in places like India, where manufacturing is growing faster than ever. This isn’t just about big names like Toyota or Caterpillar. It’s about the small workshops in Gujarat making textiles, the startups in Bengaluru building machinery parts, and the government-backed players like BEML producing earth-moving equipment that powers India’s infrastructure boom.

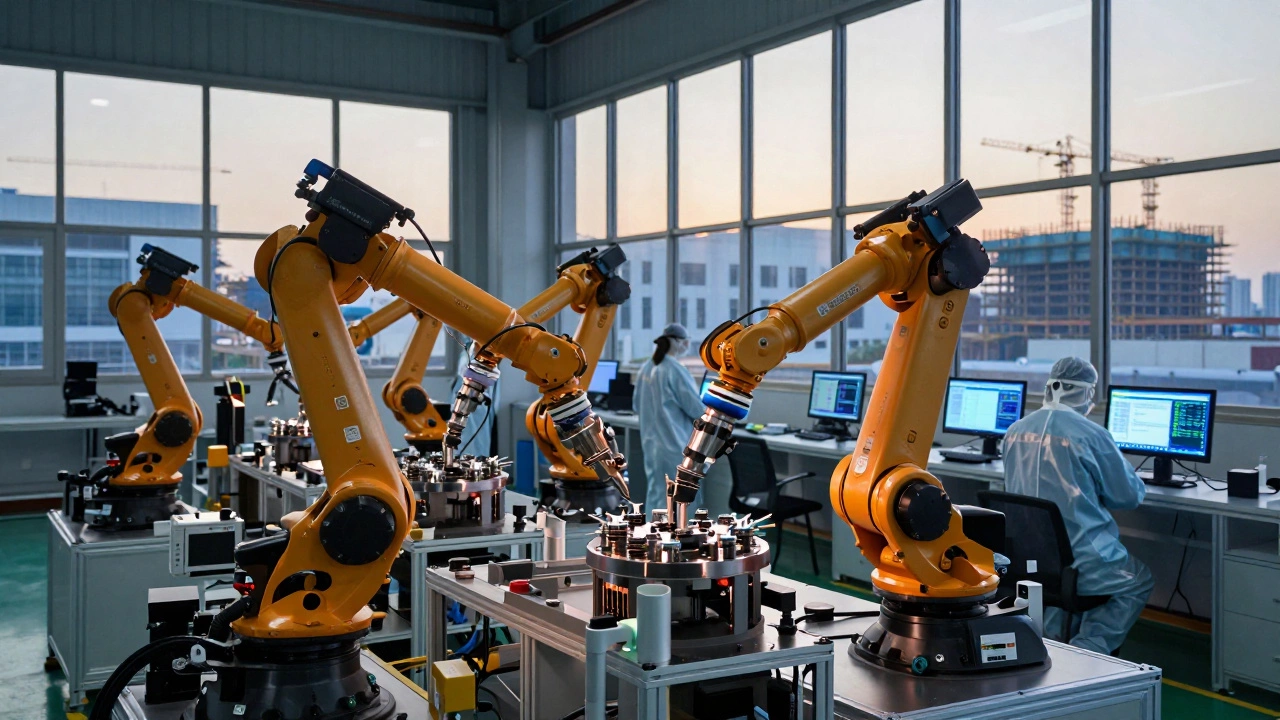

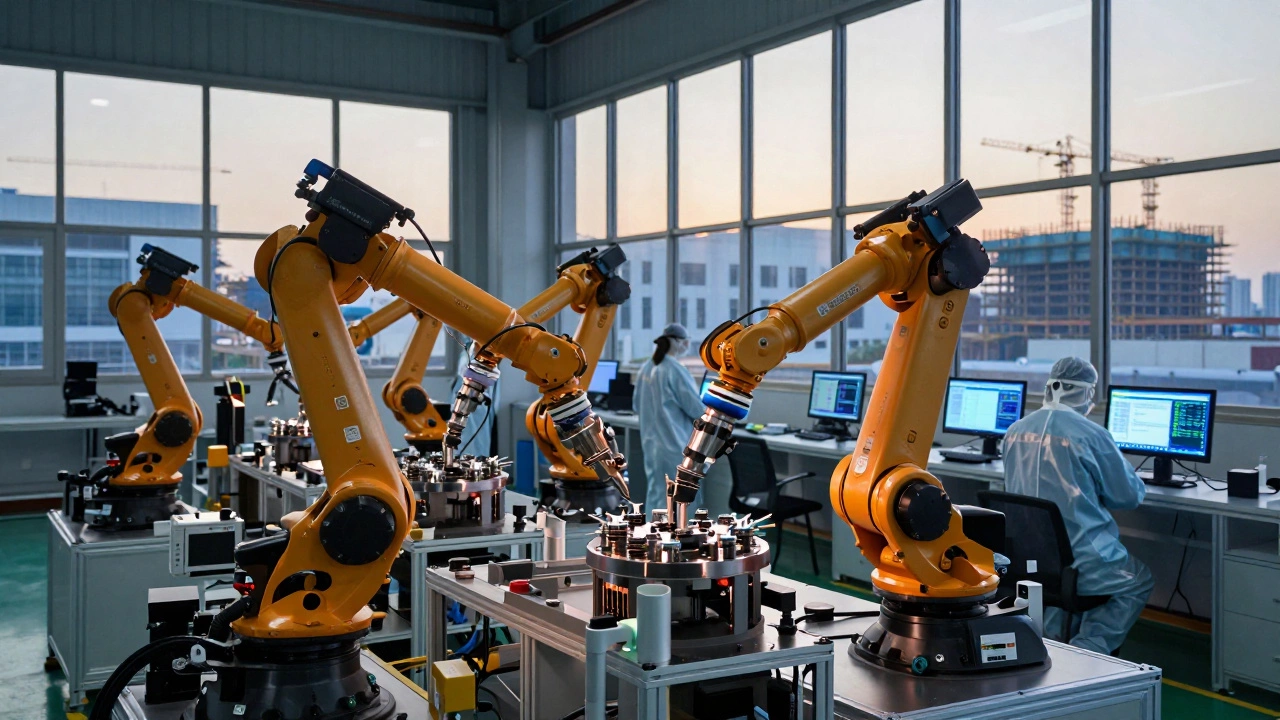

Manufacturing in India, the process of turning raw materials into finished products at scale, often with local labor and evolving technology. Also known as Indian industrial production, it’s no longer just low-cost assembly—it’s becoming a hub for quality, innovation, and export-ready output. Compared to China, India offers lower labor costs, growing government incentives, and fewer trade barriers with the U.S. and Europe. But it’s not without challenges: supply chain delays, power shortages, and compliance hurdles still hold back some players. Meanwhile, global giants like Caterpillar dominate because of their service networks, while companies like Toyota lead through vertical control—owning everything from parts to distribution. And then there’s textile manufacturing India, a massive, decentralized sector with thousands of small units producing everything from cotton yarn to high-end apparel. Also known as Indian fabric industry, it’s one of the country’s biggest employers and top export earners, led by states like Gujarat and Tamil Nadu. Meanwhile, small scale production, manufacturing done in limited volumes, often by local businesses with minimal automation. Also known as micro-manufacturing, it’s where most Indian industrial jobs actually live—not in giant plants, but in family-run units making everything from metal brackets to handwoven saris.

What you’ll find below isn’t fluff. It’s real data on who’s winning in machinery, why 90% of manufacturing startups fail, how India’s top exports to the U.S. are changing, and whether India really is cheaper than China. You’ll see who the biggest earth-moving equipment maker in Asia is (spoiler: it’s Indian), how many textile companies operate here in 2025, and why America lost its factory base. No theory. No hype. Just facts, comparisons, and lessons from the floor.

Discover the top three machinery manufacturers in India driving industrial growth: John Deere for farming, Larsen & Toubro for heavy infrastructure, and Atlas Copco for precision manufacturing. Reliable, scalable, and locally built.

Manufacturing drives America's economy, creates high-paying jobs, fuels innovation, and ensures national security. Government incentives are bringing production back home, strengthening communities and reducing trade deficits.

In 2025, Texas, Georgia, North Carolina, Tennessee, and Arizona are leading U.S. manufacturing growth with incentives, workforce training, and supply chain investments. Discover why these states are attracting billions-and how startups can benefit.

As of 2025, Toyota Motor Corporation is the world's largest manufacturing company by revenue, surpassing Samsung, Volkswagen, and Apple. Learn why vertical integration and supply chain control make Toyota the leader.

Caterpillar generates nearly $20 billion more in revenue than Komatsu and dominates global market share. Learn how size, service networks, and product range make Caterpillar the bigger player in heavy machinery.

Bharat Earth Movers Limited (BEML) is Asia's largest manufacturer of earth moving equipment, dominating India's infrastructure sector with locally built, durable machines backed by unmatched service networks and government support.

Discover which industry houses the most small businesses in Australia, see the latest ABS stats, and learn how the data can guide your next venture.

Discover why 90% of startups fail and learn practical steps to avoid common pitfalls, especially for manufacturing ventures.

Explore the main drawbacks of manufacturing, from environmental impact to high capital costs, supply‑chain risks, labor issues, and compliance burdens, plus tips to mitigate them.

Discover the top Indian industries set to explode by 2030, with growth rates, key drivers, investment needs, and actionable steps for entrepreneurs and investors.

Discover the top Indian export to the USA, why pharmaceuticals lead, and how other sectors like jewelry, chemicals, and machinery stack up in 2024 trade data.

Explore why U.S. manufacturing fell-from globalization and automation to policy choices-plus its impact on jobs, the Rust Belt, and recent reshoring attempts.