Steel Cost Difference Calculator

Calculate Your Cost Difference

See how energy, materials, and logistics impact steel production costs

How It Works

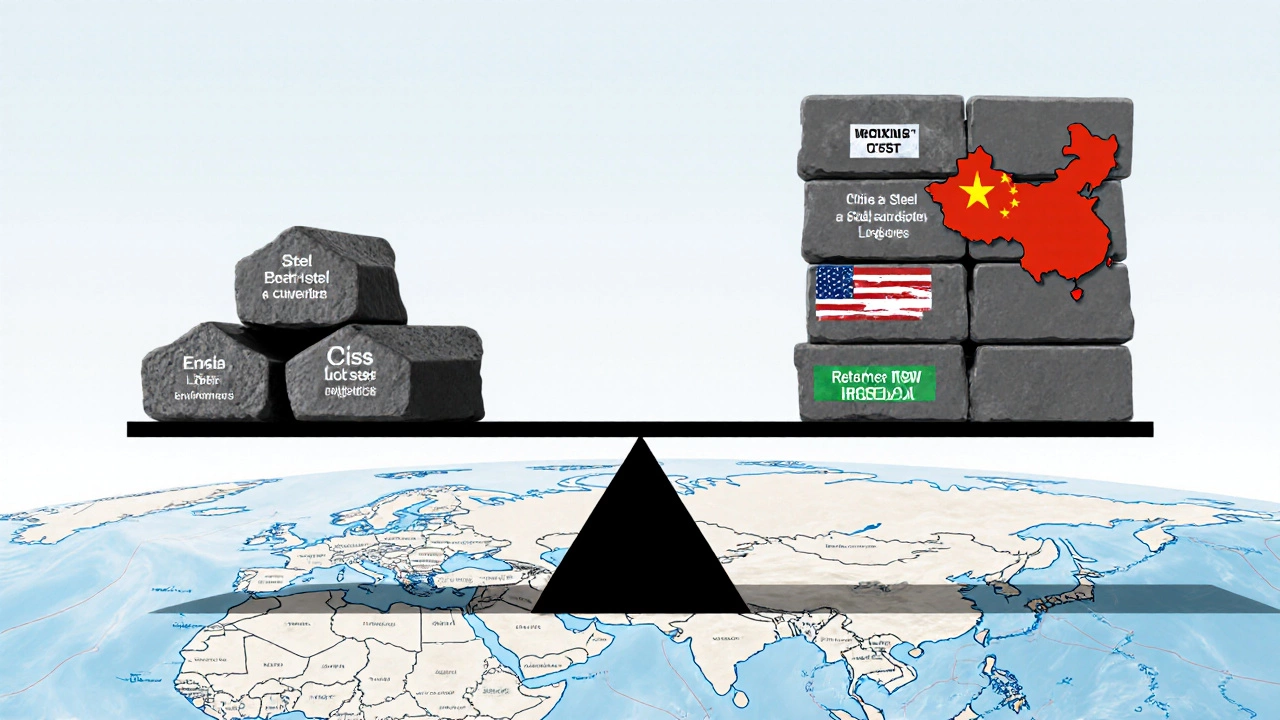

Based on article data: China produces 10.1 million tons annually with $7.5/ton energy savings, $75/ton coal cost difference, and $40/ton logistics advantage.

- Energy Costs $0.07/kWh vs $0.14/kWh

- Coking Coal $135 vs $210/ton

- Logistics $30-$50/ton advantage

- Environmental Compliance Lower costs in China

Results

When you see a price tag on a shipment of steel from China that’s 30% lower than the same grade made in Ohio or Pennsylvania, it’s easy to think it’s just about exploitation or dumping. But the truth is deeper. The price gap isn’t luck. It’s the result of decades of policy, scale, energy access, and labor systems that have reshaped global steelmaking. If you’re buying steel for construction, machinery, or even appliances, understanding why Chinese steel costs less helps you make smarter decisions - not just about price, but about quality, supply chains, and long-term risk.

Energy Costs Are the Biggest Factor

Steelmaking is energy-hungry. Making one ton of steel requires roughly 18,000-20,000 kWh of electricity and a lot of coal. In the U.S., electricity prices average $0.14 per kWh. In China, they’re around $0.07 - sometimes even lower in industrial zones where the government subsidizes power for heavy industry. That’s not a small difference. For a plant making 10 million tons a year, that’s over $1 billion saved just on electricity.

China also has direct access to low-cost coal. The country produces over 4 billion tons of coal annually, mostly from state-owned mines in Shanxi and Inner Mongolia. U.S. steelmakers rely on imported coking coal, often from Australia or Canada, which adds freight, tariffs, and market volatility to the cost. In 2024, U.S. steelmakers paid $210 per ton for coking coal. Chinese mills paid $135. That’s $75 per ton - or $750 million per 10 million tons - right there.

Scale and Efficiency

China has more steel capacity than the rest of the world combined. In 2024, China produced 1.01 billion tons of crude steel. The U.S. made 82 million tons. That’s more than 12 times the output. Big scale means big savings. Chinese mills run 24/7 with minimal downtime. They use modern electric arc furnaces and blast furnaces optimized for mass production. U.S. mills, many built in the 1970s, are older, smaller, and often run at 70-80% capacity to manage costs.

China’s largest steelmaker, Baowu Group, produces over 130 million tons a year. That’s more than the entire U.S. steel industry. With that kind of volume, they negotiate better prices for raw materials, get bulk discounts on maintenance, and spread fixed costs across far more output. U.S. producers like Nucor or ArcelorMittal USA can’t match that.

Labor Costs Are Lower - But Not Because of Exploitation

It’s true that Chinese steelworkers earn less. The average annual wage for a steelworker in China is around $8,000. In the U.S., it’s $75,000. But that gap isn’t just about wages. It’s about productivity, union rules, and safety standards.

In the U.S., steel plants have strict OSHA rules, mandatory safety training, union contracts with pension and healthcare benefits, and high insurance premiums. In China, safety standards exist but aren’t enforced as rigorously. There’s less paperwork, fewer benefits, and lower turnover because workers often stay in company towns for life. That reduces hiring and training costs.

It’s not that Chinese workers are treated badly - many live in modern dormitories and have access to healthcare. But the system doesn’t include the same social safety nets. That lowers the total cost of labor, even if the wage is lower.

Government Support and Subsidies

The Chinese government doesn’t just let the market decide. It actively shapes steel production. From 2016 to 2023, Beijing poured over $120 billion into steel industry restructuring - closing inefficient mills, upgrading technology, and subsidizing exports. They do this to maintain employment in industrial regions and to control global pricing.

These subsidies come in many forms: low-interest loans, tax breaks, free land for new plants, and even direct cash payments for meeting production targets. In 2024, the Chinese Ministry of Industry and Information Technology gave $4.7 billion in subsidies to top steel producers. U.S. steelmakers get tax credits and some trade protections, but nothing close to that scale.

That’s why Chinese steel can be sold below cost overseas. It’s not illegal dumping under WTO rules - because the subsidies are hidden in energy, land, and credit, not direct cash payments. It’s harder to prove, harder to challenge, and easier to sustain.

Environmental Rules Are Looser - And Cheaper

U.S. steel plants must meet strict EPA standards for emissions, wastewater, and particulate matter. Installing scrubbers, carbon capture systems, and wastewater treatment plants costs millions. Many U.S. mills spent over $500 million upgrading since 2010 to meet clean air rules.

In China, environmental enforcement has improved since 2018, but it’s still uneven. In rural provinces, inspections are rare. Mills can delay upgrades for years. In 2023, the Chinese Ministry of Ecology and Environment fined 2,100 steel plants for violations - but the average fine was just $12,000. That’s less than the cost of one scrubber. For many, it’s cheaper to pay the fine than fix the problem.

That means Chinese mills don’t have to factor in the same environmental costs. U.S. steel prices include compliance. Chinese prices don’t - at least not fully.

Transport and Logistics Are Built In

China’s steel is made near ports - especially in Jiangsu, Hebei, and Guangdong. These regions have deep-water ports, rail networks, and highways built specifically for moving bulk materials. A ton of steel can be loaded onto a ship in Tianjin and reach Los Angeles in 18 days.

U.S. steel is often made inland - in Ohio, Indiana, or Pennsylvania. Getting it to the West Coast means trucking it to a rail hub, then shipping it cross-country. That adds $30-$50 per ton in logistics. Chinese steel includes shipping in the price. U.S. steel doesn’t - and that’s before you even get to import tariffs.

Quality Isn’t Always the Same - But It’s Getting Closer

Some assume cheaper steel means lower quality. That used to be true. In the 2000s, Chinese steel had inconsistent carbon content, poor tensile strength, and high impurities. But that’s changed. Today, top Chinese mills like Baowu and Shagang produce steel that meets ASTM and ISO standards. Many U.S. auto suppliers now use Chinese steel for non-critical parts like brackets, frames, and housings.

For structural beams, bridges, or pressure vessels, U.S. steel is still preferred. But for fencing, shelving, or machinery casings, Chinese steel is reliable and cost-effective. The gap in quality has narrowed - but the price gap hasn’t.

Who Wins? Who Loses?

Buyers win - especially small manufacturers, contractors, and retailers who need affordable materials. U.S. steelworkers and their communities lose. Since 2000, the U.S. steel industry has lost over 200,000 jobs. Many plants closed. Towns like Youngstown, Ohio, still feel the impact.

China wins by controlling supply and keeping its industry alive. But there’s a cost. Overproduction led to a global glut in 2015-2017, which hurt steelmakers everywhere. Now China is cutting capacity slowly, trying to balance exports with domestic demand.

The real winner? Global consumers. From refrigerators to cars to solar panel frames - cheaper steel makes everything else cheaper. But it also makes it harder for U.S. producers to invest in green tech, automation, or innovation.

What Does This Mean for You?

If you’re buying steel:

- For high-stress applications (bridges, pipelines, heavy machinery) - stick with U.S. or EU steel. The traceability, certifications, and consistency matter.

- For low-risk uses (fencing, shelving, containers) - Chinese steel is often the smart choice. Look for mills with ISO 9001 certification.

- Always ask for mill test reports. A good supplier will provide them. Don’t accept just a price quote.

- Consider total landed cost. Sometimes, cheaper steel from China ends up costing more when you factor in longer lead times, customs delays, or returns.

The price difference isn’t magic. It’s math - energy, scale, labor, subsidies, and rules. Understanding that helps you choose wisely, not just cheaply.

Is Chinese steel safe to use in construction?

Yes - but only if it meets international standards like ASTM or EN. Many Chinese mills now produce structural steel certified for global use. Always request a mill test report (MTR) that shows chemical composition and mechanical properties. Avoid suppliers who won’t provide documentation.

Why doesn’t the U.S. just build more steel mills?

Building a new steel mill costs $2-$5 billion. U.S. investors are hesitant because of uncertain demand, high energy costs, and competition from cheap imports. Even with tariffs, Chinese steel often remains cheaper. Without massive government subsidies - like China gets - new U.S. mills struggle to compete.

Do U.S. tariffs on Chinese steel work?

They’ve slowed imports but haven’t stopped them. Since 2018, the U.S. has imposed 25% tariffs on Chinese steel. Imports dropped by 40% initially, but Chinese exporters shifted through Vietnam, Mexico, and Turkey. By 2024, U.S. steel imports from China were back to 60% of pre-tariff levels - just routed differently. Tariffs protect U.S. jobs but raise prices for American manufacturers.

Can U.S. steel become cheaper?

Only with major changes: cheaper clean energy (like nuclear or hydrogen), federal subsidies for modernization, and relaxed environmental rules - none of which are politically likely. Some U.S. mills are switching to electric arc furnaces using scrap steel, which cuts energy use by 60%. That’s the most realistic path to lower costs - but it still won’t match China’s scale.

What’s the environmental impact of choosing Chinese steel?

Producing steel in China generates about 2.2 tons of CO₂ per ton of steel. In the U.S., it’s about 1.7 tons - thanks to more scrap recycling and newer electric furnaces. So choosing U.S. steel reduces your carbon footprint. But if you’re using Chinese steel for non-structural uses, the overall environmental impact of the final product might be small. The bigger issue is global emissions - China’s steel output accounts for over half of the world’s steel-related CO₂.