IKEA Market Potential Calculator

Calculate Market Potential

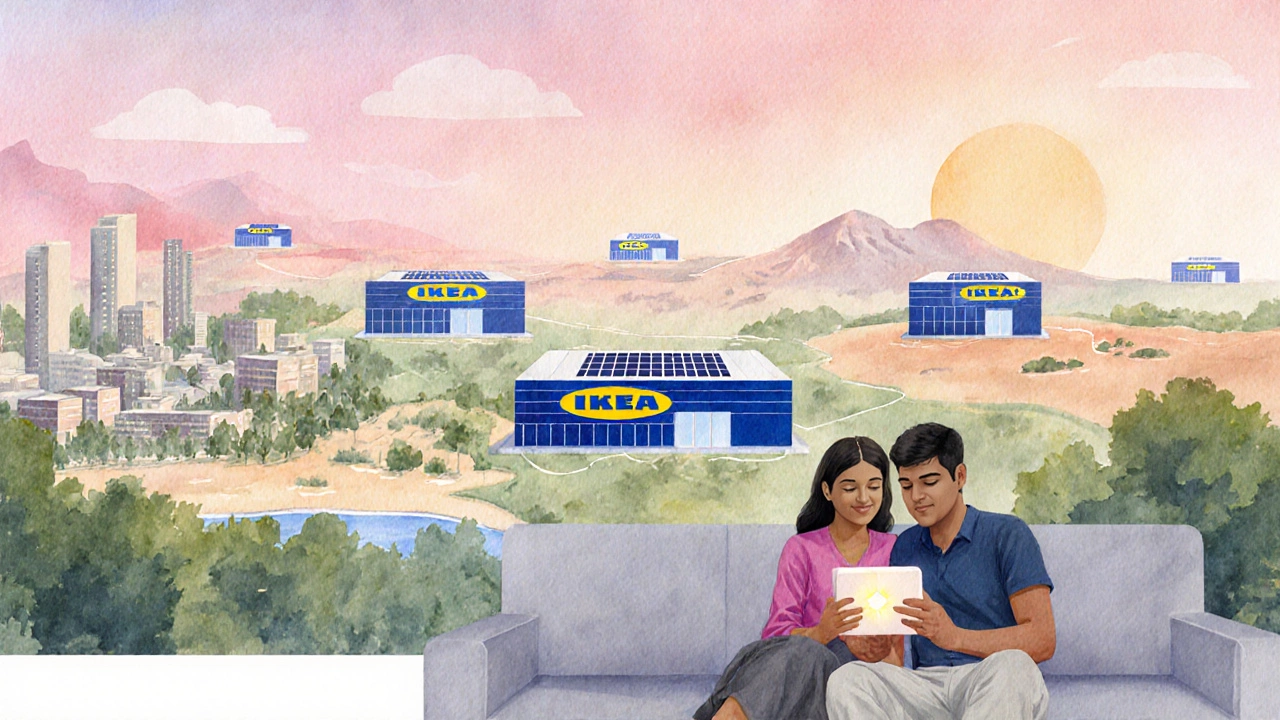

Estimate revenue potential based on key factors from IKEA's India expansion strategy

Projected Market Value

$0BBased on: $12B market size, 8% CAGR, 5 years, 60% local sourcing

When IKEA is a Swedish multinational that designs and sells ready‑to‑assemble furniture started scouting Asia, India the world’s second‑largest population and a fast‑growing economy emerged as a magnet. The company didn’t pick India on a whim; it weighed market size, demographics, policy incentives, real‑estate dynamics, and supply‑chain possibilities. Below we unpack the exact reasons that convinced IKEA to plant its first mega‑store in Hyderabad in 2018 and to keep rolling out new locations across the country.

Key Takeaways

- India’s rising middle class offers a huge, price‑sensitive consumer base that matches IKEA’s value proposition.

- Government initiatives like Make in India a policy aimed at boosting domestic manufacturing and attracting foreign investment provide tax breaks and easier import rules for locally sourced goods.

- Rapid urbanisation and changing living spaces create demand for affordable, modular furniture.

- Strategic real‑estate deals in tier‑2 cities lower entry costs while expanding reach.

- Building a local supply chain reduces logistics expenses and aligns with sustainability goals.

Massive Market Potential

India’s furniture market was valued at roughly $12 billion in 2023 and is projected to hit $20 billion by 2030, according to a report by the Confederation of Indian Industry. That growth is driven by a Urban Middle Class a demographic segment earning between $5,000 and $20,000 annually and seeking modern home solutions. Unlike many Western markets where furniture purchases are occasional, Indian consumers buy more frequently as they set up new homes, move for jobs, or upgrade living standards.

For IKEA, whose business model relies on high volume and low margin, a market that can sustain repeat purchases is gold. The company’s flat‑pack design also appeals to renters who need easy‑to‑move items.

Government Policies that Made the Deal Sweet

The Indian government’s Make in India initiative launched in 2014 to encourage manufacturing within the country offered IKEA incentives to source at least 50 % of its product range locally. This reduced import duties and opened avenues for joint ventures with Indian manufacturers.

Additionally, the “Organised Retail” policy-formalised under the Foreign Direct Investment (FDI) framework-allowed foreign retailers to own up to 100 % of wholly owned stores, provided they complied with certain location and equity conditions. Earlier restrictions that limited foreign investment in retail were eased, giving IKEA the green light to operate its own stores rather than partnering with local chains.

Real‑Estate Strategy: Tier‑2 Cities as Growth Engines

Land prices in metropolitan hubs like Mumbai and Delhi are prohibitive for IKEA’s sprawling store format, which typically exceeds 30,000 sq ft. The company therefore turned to tier‑2 cities-Hyderabad, Bangalore, and later, Ahmedabad-where land costs are 30‑40 % lower.

These cities also present less competition from existing furniture retailers, allowing IKEA to dominate the value‑segment space early on. Partnerships with local developers helped secure sites near major highways, ensuring easy access for families driving from surrounding towns.

Building a Local Supply Chain

Supply‑chain efficiency is a core pillar of IKEA’s cost advantage. In India, the firm set up a 25,000 sq ft distribution centre near Hyderabad and invested in local factories that produce wood, metal, and textile components.

By sourcing 60 % of its range from Indian suppliers-spanning from plywood producers in Tamil Nadu to textile mills in Gujarat-

The move created a ripple effect, boosting ancillary industries like logistics, packaging, and design services. Over 2,000 jobs were generated directly in manufacturing, with thousands more in related sectors.

Brand Fit: Affordable Design Meets Indian Aspirations

IKEA’s “democratic design” mantra-good design, function, quality, sustainability, and low price-resonates deeply with Indian shoppers who are price‑sensitive yet increasingly design‑aware. The brand launched collections that incorporate local motifs, such as traditional hand‑woven cushions, while keeping the core flat‑pack philosophy.

Marketing campaigns featuring Indian families assembling furniture in under a minute tapped into the aspirational narrative of modern Indian living. The tagline “Everything you need for a better everyday life” was localized to speak about space optimisation, a key concern in smaller Indian apartments.

Risks and Mitigation Strategies

Entering a new market always carries pitfalls. IKEA faced challenges around bureaucratic delays, varying state regulations, and a fragmented retail ecosystem. To mitigate these, the company hired local legal experts, set up a dedicated India‑focused steering committee, and embraced a flexible store format-testing smaller “city‑center” stores in Bengaluru after the success of large‑format outlets.

Another risk involved cultural perception of foreign brands. IKEA combated this by emphasizing local sourcing percentages in its advertising, thereby positioning itself as a contributor to Indian manufacturing rather than a pure import player.

Comparison of Key Attraction Factors vs. Other Asian Markets

| Factor | India | China | Vietnam |

|---|---|---|---|

| Market Size (2023) | $12 bn | $20 bn | $3 bn |

| Middle‑Class Growth Rate | 8 % CAGR | 5 % CAGR | 7 % CAGR |

| Land Cost for Mega‑Store | Low (tier‑2 cities) | High (metro hubs) | Moderate |

| Make‑in‑Policy Incentives | Strong (tax breaks, local‑sourcing targets) | Medium (special economic zones) | Growing (investment incentives) |

| Supply‑Chain Maturity | Emerging but fast‑growing | Highly developed | Developing |

Future Outlook

With ten stores planned across six states by 2028, IKEA expects its Indian revenue to contribute roughly 15 % of its global sales by 2030. The company continues to explore smaller urban formats, e‑commerce integration, and renewable‑energy‑powered warehouses to stay ahead of competition.

In short, the mix of a booming consumer base, supportive policies, affordable real‑estate, and a willingness to invest in local manufacturing made India an irresistible destination for IKEA’s growth engine.

Why did IKEA choose Hyderabad for its first Indian store?

Hyderabad offered a combination of lower land costs, a tech‑savvy population, and good connectivity to other South‑Indian cities, making it an ideal test market for IKEA’s large‑format concept.

How does the Make in India policy benefit IKEA?

The policy gives tax holidays and easier customs procedures for products that are 50 % or more locally sourced, helping IKEA keep prices low while complying with its sustainability goals.

What challenges did IKEA face when entering the Indian market?

Regulatory delays, diverse state laws, and the need to adapt product sizes for smaller Indian homes were the main hurdles. IKEA tackled these with local legal teams and by designing space‑saving furniture.

Is IKEA planning to open more stores in tier‑1 cities like Mumbai?

Yes, but it will likely use a smaller store format to manage higher land prices while still offering the core product range.

How does IKEA’s supply chain in India differ from its global model?

In India, IKEA sources about 60 % of its items locally, uses a central distribution centre near Hyderabad, and partners with regional manufacturers to reduce lead times and import duties.