Steel Production Comparison Calculator

Production Data

Results

Nucor's 24M tons represent approximately 20% of US steel production. The article notes that Nucor produces more steel than the next three largest producers combined.

The biggest steel supplier in the US isn’t a single company you’d recognize from TV ads-it’s Nucor Corporation. Headquartered in Charlotte, North Carolina, Nucor produces more raw steel than any other company in the country. In 2024, it produced over 24 million tons of steel, accounting for nearly 20% of total US steel output. That’s more than the next three largest producers combined.

How Nucor Became the Leader

Nucor didn’t get there by building giant blast furnaces like the old-school mills in Pittsburgh or Gary. Instead, it bet big on electric arc furnaces (EAFs) in the 1970s and 80s. These furnaces melt scrap metal using electricity instead of coal and iron ore. It’s cheaper, faster, and uses 75% less energy than traditional methods. Today, over 90% of Nucor’s steel comes from recycled scrap. That’s not just smart business-it’s why the company kept growing while older rivals struggled with rising fuel costs and environmental regulations.

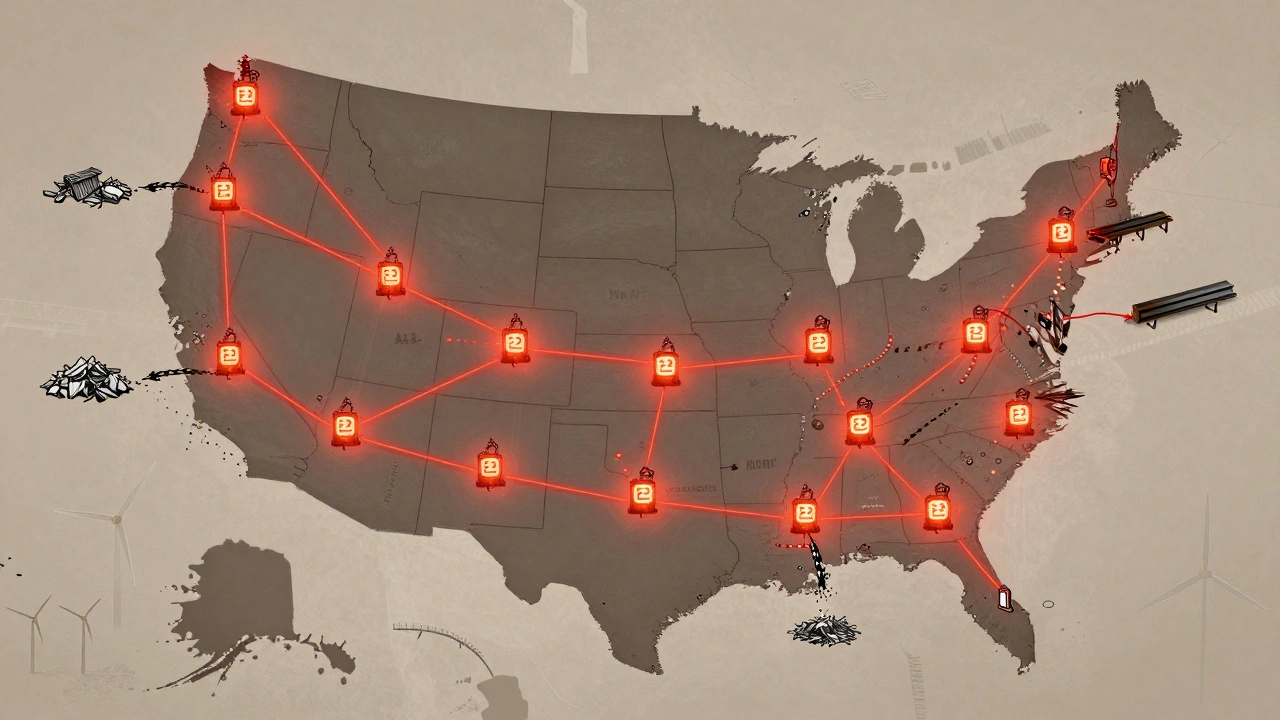

By 2025, Nucor operates 22 steel mills across 16 states. Each one is a self-contained factory-rolling, coating, cutting, and shipping steel from the same site. This vertical integration cuts shipping costs and lets them respond to demand faster. One mill in Crawfordsville, Indiana, alone produces enough rebar to build 1,200 single-family homes every week.

Who Else Is in the Top Tier?

Nucor leads, but it’s not alone. The next biggest players are:

- United States Steel (U.S. Steel) - Still a household name, but its output has dropped to about 11 million tons a year. It runs the last major integrated steel plant in the US at its Gary, Indiana facility, which uses blast furnaces. It’s expensive to run, but it makes high-grade steel for cars and appliances that EAFs can’t yet match.

- ArcelorMittal USA - The American branch of the world’s largest steelmaker. It operates five mills, mostly in the Midwest and Northeast. It produces around 10 million tons annually, focusing on flat-rolled steel for automotive and construction.

- Steel Dynamics - Based in Indiana, this company has grown fast since the 1990s. It’s the fourth-largest producer, with 12 mills and about 9 million tons of annual output. Like Nucor, it relies heavily on EAFs and scrap recycling.

Together, these four companies make up over 60% of all steel produced in the US. The rest comes from smaller regional mills, specialty producers, and imported steel.

Why Scrap Recycling Matters

Most people don’t realize that nearly 70% of all steel made in the US comes from recycled materials. That’s because steel is infinitely recyclable-no loss in quality, even after being melted down dozens of times. Nucor and Steel Dynamics buy scrap from auto junkyards, demolition sites, and old appliances. They pay per ton, creating a whole secondary economy around steel recovery.

This system keeps prices lower and reduces dependence on imported iron ore. In 2024, the US imported less than 10% of its steel needs, down from 30% in 2010. The reason? Domestic scrap supply is reliable, and EAF mills can ramp up production in weeks, not years.

Where the Steel Goes

The biggest buyers of US-made steel aren’t big-box stores or car dealerships-they’re construction contractors and manufacturers. About 40% of domestic steel goes into building infrastructure: bridges, highways, warehouses, and commercial buildings. Another 25% is used in automotive parts, appliances, and machinery. The rest goes into pipelines, oil rigs, and industrial equipment.

Nucor’s most popular product? Structural steel beams and rebar. These are the skeletons of modern buildings. If you’ve walked through a new apartment complex, warehouse, or school built in the last five years, there’s a good chance Nucor made the steel holding it up.

Challenges Ahead

Even the biggest supplier faces pressure. Labor shortages hit steel mills hard-welders, crane operators, and furnace technicians are in short supply. Training programs are expanding, but it takes years to become skilled. Then there’s competition from imports. China still produces more steel than the entire rest of the world combined. Even with tariffs, cheap foreign steel sometimes floods the market during economic slowdowns.

Another issue: decarbonization. While EAFs are cleaner than blast furnaces, they still use a lot of electricity. Nucor is investing in solar and wind power for its mills. By 2030, it plans to cut emissions by 40% using renewable energy and hydrogen-based technologies.

What This Means for Buyers

If you’re a contractor, manufacturer, or distributor looking for steel, knowing who supplies what matters. Nucor is your best bet for rebar, structural shapes, and sheet metal in bulk. If you need ultra-thin, high-strength steel for electric vehicle frames, U.S. Steel or ArcelorMittal might be better options. For specialty alloys used in aerospace or medical devices, you’ll need to go to smaller producers like Allegheny Technologies or Carpenter Technology.

Price volatility is real. Steel prices jumped 35% in 2021 after supply chain disruptions. Since then, they’ve stabilized-but still swing 10-15% annually based on scrap costs and energy prices. Locking in long-term contracts with Nucor or Steel Dynamics can save money over time.

The Future of Steel in America

The Inflation Reduction Act and the Bipartisan Infrastructure Law are pouring billions into domestic manufacturing. New steel plants are being planned in Texas, Georgia, and Ohio-mostly EAF-based. The goal? Reduce reliance on foreign steel and support the clean energy transition. Wind turbines need thousands of tons of steel per project. Electric vehicle production requires more steel per car than gas-powered ones.

Nucor is already building a new $1.2 billion mill in Texas to supply the growing solar and EV markets. It’s not just about being the biggest supplier anymore-it’s about being the most adaptable one.

For now, Nucor holds the title as the biggest steel supplier in the US-not because it’s the oldest, but because it’s the most efficient, the most responsive, and the most aligned with where the market is headed.

Is Nucor the largest steel producer in the world?

No, Nucor is the largest steel producer in the US, but not globally. ArcelorMittal, based in Luxembourg, is the world’s biggest steelmaker, producing over 70 million tons annually. Nucor’s output is around 24 million tons, which puts it in the top 10 globally but far behind the top three.

Where does the US get its steel from if not from Nucor?

About 90% of US steel is made domestically. The rest comes from Canada, Mexico, South Korea, Japan, and Brazil. Imports are mostly flat-rolled steel for cars and appliances. Since 2018, the US has imposed tariffs on steel imports to protect domestic producers, which has helped keep most of the market in American hands.

Can EAF steel match the quality of blast furnace steel?

For most applications, yes. EAF steel is now used in everything from skyscrapers to car frames. The main exception is ultra-high-strength steels used in aerospace or military applications, which still require the precise chemistry control of blast furnaces. But even there, EAF technology is catching up fast.

How much steel does the average American use in a year?

The average American uses about 500 pounds of steel per year-mostly in cars, appliances, buildings, and packaging. That adds up to over 160 million tons consumed annually across the country. Nearly all of it is recycled at least once before being discarded.

Why don’t more US companies use blast furnaces anymore?

Blast furnaces are expensive to build and operate. They need constant supplies of iron ore and coke (a type of coal), which must be shipped from overseas. They also emit more carbon and take years to restart if they shut down. EAFs are cheaper, faster to start, and use recycled scrap-making them more flexible and profitable in today’s market.